No; I'm well aware that regulation is better than prohibition in the long-run, but I'm assuming the Russian mafia is still a thing, as is endemic corruption in general and in law enforcement in particular. We need to completely clean house first before trying to adopt the regulative approach, right now, prohibition is only prudent.Should marijuana be legalized in Russia?

A) Yes

B) No

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

A New Beginning - Our 1992 Russian Federation

- Thread starter panpiotr

- Start date

-

- Tags

- russia russian federation

Threadmarks

View all 148 threadmarks

Reader mode

Reader mode

Recent threadmarks

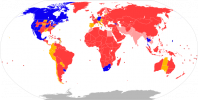

AvtoVAZ - Russian Volkswagen (2010) Federal budget Undermining American global financial domination (2010) New game GDP Ranking (2011) Chapter Thirty One: Nothing Lasts Forever (April - December 2010) Part I Chapter Thirty One: Nothing Lasts Forever (April - December 2010) Part II Map of the world (12/2010)Why should we want to legalise marijuana this thing is not legal even in most of Europe?

Attachments

The S-300 would certainly be a nasty surprise for the Israelis if Gaddafi decides to restart/crank up his nuclear ambitions, especially if employed in a combined arms approach with MiG-29s and Su-27s. They do have a thing for preemptive strikes...shame if those F-15s of theirs ran into interceptors and/or a SAM umbrella.I agree, plus their money will help us fund more. We might also sell them some S-300s and various other bits like BR-T55, 9P148 Konkurs, 9K33M3 "Osa-AKM", Kub-M4 and others. That will give any opponents a nasty time. The AA and SPAAG will give any Western attackers a rough time, the tanks and the IFV will give any local rebels an issue.

Should marijuana be legalized in Russia?

B) No

We are still, or have just left the fight against the alcohol, i don't think that we need marijuana .

B...others had already make their case...and this particular vote make me wonder....Should marijuana be legalized in Russia?

A) Yes

B) No

If there is any OTL Russian legislator that is seriously high enough to even consider this proposal..../sShould the new government coalition (whoever it is) pursue liquid democracy at local levels in Russia?

A) Yes

B) No

links:

Liquid democracy - Wikipedia

en.wikipedia.org

What is a Liquid Democracy? - Follow My Vote

Learn about what exactly liquid democracy is as well as the history and conflicts behind it. Also, find out what countries are currently using it in one form or another.followmyvote.com

Obvious No BTW, the fact this would be the first time a significant amount of readers even encounter a mention of liquid democracy seems like this proposal should not be even discussed until one significant unit (whether a state/province or even a county) outside of Russia had managed to able to implement even some kind of this....

Population ranking (2009)

Population rankings for 2009 are as follows:

1. China - 1,340,000,000

2. India - 1,220,000,000

3. United States - 308,510,000

4. Indonesia - 240,980,000

5. Brazil - 194,520,000

6. Pakistan - 190,120,000

7. Union State - 186,800,000

8. Nigeria - 156,600,000

9. Bangladesh - 146,710,000

10. Japan - 128,120,000

11. Mexico - 111,050,000

12. Philippines - 92,950,000

13. Ethiopia -86,760,000

14. Vietnam - 86,480,000

15. Egypt - 85,500,000

16. Germany - 84,600,000

17. Iran - 74,320,000

18. Turkey - 72,230,000

19. Thailand - 67,810,000

20. Congo -64,270,000

21. United Kingdom - 62,240,000

22. France - 62,090,000

23. Italy - 59,560,000

24. South Africa - 51,170,000

25. Myanmar - 49,020,000

Note, that although we have slipped, we are in no danger of dropping out of the top 10 and there is a high likelihood we will climb up soon seeing how the economy is really beginning to boom.

1. China - 1,340,000,000

2. India - 1,220,000,000

3. United States - 308,510,000

4. Indonesia - 240,980,000

5. Brazil - 194,520,000

6. Pakistan - 190,120,000

7. Union State - 186,800,000

8. Nigeria - 156,600,000

9. Bangladesh - 146,710,000

10. Japan - 128,120,000

11. Mexico - 111,050,000

12. Philippines - 92,950,000

13. Ethiopia -86,760,000

14. Vietnam - 86,480,000

15. Egypt - 85,500,000

16. Germany - 84,600,000

17. Iran - 74,320,000

18. Turkey - 72,230,000

19. Thailand - 67,810,000

20. Congo -64,270,000

21. United Kingdom - 62,240,000

22. France - 62,090,000

23. Italy - 59,560,000

24. South Africa - 51,170,000

25. Myanmar - 49,020,000

Note, that although we have slipped, we are in no danger of dropping out of the top 10 and there is a high likelihood we will climb up soon seeing how the economy is really beginning to boom.

AbstentionShould the new government coalition (whoever it is) pursue liquid democracy at local levels in Russia?

YeaShould marijuana be legalized in Russia?

A) Yes

B) No

BShould the new government coalition (whoever it is) pursue liquid democracy at local levels in Russia?

A) Yes

B) No

links:

Liquid democracy - Wikipedia

en.wikipedia.org

What is a Liquid Democracy? - Follow My Vote

Learn about what exactly liquid democracy is as well as the history and conflicts behind it. Also, find out what countries are currently using it in one form or another.followmyvote.com

AShould marijuana be legalized in Russia?

A) Yes

B) No

Great stuff, but a couple of problems. I think for a lot of them you have used OTL numbers instead of ATL. For example Germany has an economic size of $4.9T but your stats have taken a lower approximation of $3.4T. India, the UK and France too are all too small here unfortunately. I understand this probably means more work for you unfortunately, sorry about that!

Country 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028

Last edited:

A, we can tax it taking money out of the mafia and into the economy and we can siphon ‘drug tourists’ from the countries that have legalized it.

Crap, I probably did. Let me fix that up, thanks!Great stuff, but a couple of problems. I think for a lot of them you have used OTL numbers instead of ATL. For example Germany has an economic size of $4.9T but your stats have taken a lower approximation of $3.4T. India, the UK and France too are all too small here unfortunately. I understand this probably means for work for you unfortunately, sorry about that!

edit: I see what I did, I copied those countries from the unalterated table, not the updated. So thankfully its a small change!

edit2: I see it changes the final year number, it's now USA, China, Union State, India, Germany, Japan.

edit3: @panpiotr, I added a graph now to make the numbers even more obvious.

edit4: @panpiotr, I added two additional tables, the YoY growth of the top 3 and the difference between the Chinese GDP and the Union State GDP. As you can see the gap is declining.

edit5: after @panpiotr liked my post, but I didnt want to double post:

I'd love to, but unfortunately that isn't feasible yet. I would very much encourage parties to do it as much as possible though.Should the new government coalition (whoever it is) pursue liquid democracy at local levels in Russia?

B) No

Frankly it's going to be used anyway. Unfortunately, the Dutch system doesn't work, the supply is not government controlled. So ideally we create a government monopoly on the production of it, making it close to worthless for criminals to produce. We can sell it at cost and force the POS to only buy from us. As long as it is not more expensive then alcohol, the risk is relatively low from a criminal perspective. And yes, it's another substance, but alcohol has proven to be impossible to eradicate, unfortunately the same applies to soft drugs. Weed also has good properties as medication, where as alcohol (mostly) just sucks.Should marijuana be legalized in Russia?

A) Yes

Last edited:

B) Seems a bit complicated and easy to screw up.Should the new government coalition (whoever it is) pursue liquid democracy at local levels in Russia?

A) Yes

B) No

A) It's mostly harmless and can raise a lot in taxes.Should marijuana be legalized in Russia?

A) Yes

B) No

Many thanks for you work mate, really appreciate it!Crap, I probably did. Let me fix that up, thanks!

edit: I see what I did, I copied those countries from the unalterated table, not the updated. So thankfully its a small change!

edit2: I see it changes the final year number, it's now USA, China, Union State, India, Germany, Japan.

edit3: @panpiotr, I added a graph now to make the numbers even more obvious.

edit4: @panpiotr, I added two additional tables, the YoY growth of the top 3 and the difference between the Chinese GDP and the Union State GDP. As you can see the gap is declining.

edit5: after @panpiotr liked my post, but I didnt want to double post:

I'd love to, but unfortunately that isn't feasible yet. I would very much encourage parties to do it as much as possible though.

Frankly it's going to be used anyway. Unfortunately, the Dutch system doesn't work, the supply is not government controlled. So ideally we create a government monopoly on the production of it, making it close to worthless for criminals to produce. We can sell it at cost and force the POS to only buy from us. As long as it is not more expensive then alcohol, the risk is relatively low from a criminal perspective. And yes, it's another substance, but alcohol has proven to be impossible to eradicate, unfortunately the same applies to soft drugs. Weed also has good properties as medication, where as alcohol (mostly) just sucks.

Russia in Southern Europe (2010)

(Typical residence in Southern Europe, now owned by Russians)

During the aftermath of the global economic crisis of 2008-2009, many countries in Southern Europe, including Portugal, Spain, Italy, Greece, and Cyprus, found themselves grappling with severe economic challenges. High unemployment rates, stagnant growth, and mounting debt levels created an environment of uncertainty and instability, prompting a wave of financial distress across the region. Amidst this turmoil, Russians with substantial financial resources saw an opportunity to invest in distressed assets and capitalize on favorable market conditions. Fueled by a desire to diversify their investment portfolios and seek out lucrative opportunities abroad, Russian investors flocked to Southern Europe, armed with bags full of dollars, euros, and gold. With their strong purchasing power and appetite for risk, these investors embarked on a buying spree, snapping up properties, companies, and businesses at bargain prices. Real estate emerged as a particularly attractive investment avenue for Russian buyers, drawn by the allure of picturesque landscapes, cultural heritage, and favorable property laws in countries like Spain, Italy, and Greece. Luxury villas overlooking the Mediterranean, historic estates nestled in the Tuscan countryside, and beachfront properties along the Algarve coast became prized assets in the portfolios of Russian investors seeking both financial returns and lifestyle enhancements.

In addition to real estate, Russian investors also targeted distressed businesses and companies in Southern Europe, viewing them as undervalued assets ripe for turnaround and revitalization. From small-scale enterprises to large corporations, no sector was immune to the influx of Russian capital, as investors sought to capitalize on opportunities across a diverse range of industries, including tourism, hospitality, manufacturing, and finance. The influx of Russian investment brought much-needed liquidity to struggling economies in Southern Europe, injecting new life into local businesses and fueling economic activity. In some cases, Russian investors played an active role in restructuring and modernizing acquired assets, bringing in new management teams, implementing efficiency measures, and introducing innovative business models to drive growth and profitability. However, the surge in Russian investment also sparked concerns about the potential implications for local economies and communities. Critics raised questions about issues such as wealth inequality, cultural assimilation, and the long-term impact of foreign ownership on national sovereignty. Additionally, the concentration of wealth in the hands of a select group of Russian investors raised concerns about transparency, accountability, and the risk of corruption in certain transactions. Despite these challenges, the influx of Russian investment had a significant impact on the economic landscape of Southern Europe during this period. It provided much-needed capital infusion, stimulated economic growth, and created opportunities for job creation and business development. However, it also underscored the complexities and risks associated with cross-border investment and raised broader questions about the intersection of global finance, national identity, and economic sovereignty in an interconnected world.

(Port of Piraeus - now in Russian controll)

The Russian state, bolstered by a thriving economy and substantial financial reserves, catalyzed a strategic shopping spree in Southern Europe, reshaping the economic and political landscape of the region. Among the notable acquisitions during this period was the purchase of the Port of Piraeus by Sovcomflot, a leading Russian maritime company. This landmark deal signaled Russia's concerted efforts to expand its influence in Southern Europe, particularly in Greece, and underscored its growing role as a major player in global commerce. The Port of Piraeus, located on the southeastern coast of Greece and serving as the country's largest port, represented a coveted asset with immense strategic value. Its prime location along key shipping routes in the Mediterranean made it an indispensable hub for international trade and maritime transport. Recognizing the port's significance and potential for growth, Sovcomflot seized the opportunity to acquire a controlling stake in the facility, thereby securing a foothold in one of Europe's most important maritime gateways. Sovcomflot's acquisition of the Port of Piraeus was driven by a strategic vision to expand its maritime operations and strengthen its position in the global shipping industry. With a fleet of state-of-the-art vessels and extensive expertise in maritime logistics, Sovcomflot was well-positioned to capitalize on the port's strategic location and infrastructure to enhance its shipping services and expand its reach into European markets.

Furthermore, the purchase of the Port of Piraeus represented more than just a business transaction for Sovcomflot; it was a strategic investment aimed at bolstering Russia's economic and political influence in Southern Europe. By gaining control over a critical maritime asset, Sovcomflot positioned itself as a key player in Greece's infrastructure development and economic revitalization efforts. The acquisition also afforded Russia greater leverage and influence in Greek politics and policymaking, enabling it to shape decisions related to trade, investment, and regional cooperation. The implications of Sovcomflot's acquisition of the Port of Piraeus reverberated beyond Greece, sending ripples throughout Southern Europe and the broader international community. The move underscored Russia's ambition to expand its presence in strategic locations around the world and challenge the dominance of traditional Western powers. It also raised concerns among Western policymakers about the extent of Russia's economic and political influence in Europe and its implications for regional stability and security. Sovcomflot's purchase of the Port of Piraeus represented a watershed moment in Russia's efforts to expand its economic and political footprint in Southern Europe. It symbolized Russia's growing assertiveness on the global stage and highlighted the evolving dynamics of geopolitical competition in the Mediterranean region. As Russia continues to pursue its strategic interests in key maritime hubs around the world, the acquisition of the Port of Piraeus stands as a testament to its ambition and influence in shaping the future of global commerce.

(The Morava-Vardar Canal will boost economies of Balkan states, as well as Russian influence)

The financing and construction of the Morava-Vardar Canal represented a monumental undertaking that reshaped the economic and geopolitical landscape of the Balkans, forging closer ties between Russia and several Southeast European countries. With Russia providing 100% of the funding, amounting to 17 billion euros, the project underscored Russia's commitment to expanding its influence in the region while promoting economic development and cooperation among its allies. The Morava-Vardar Canal, a strategic waterway connecting the Morava and Vardar rivers, served as a vital artery for transportation and commerce, facilitating the movement of goods and resources between landlocked regions in the Balkans and major maritime trade routes in the Mediterranean. The canal's construction was a complex engineering feat, involving the dredging and excavation of water channels, the construction of locks and dams, and the installation of navigation aids to ensure safe passage for vessels of varying sizes. Russia's decision to finance the project in its entirety reflected its strategic interests in enhancing connectivity and trade relations with its partners in Southeast Europe. By investing in the construction of the Morava-Vardar Canal, Russia aimed to bolster economic cooperation and foster closer ties with Yugoslavia, Macedonia, Bulgaria, and Greece, countries that shared historical, cultural, and strategic affinities with Russia.

The collaborative nature of the project underscored the importance of regional cooperation in addressing common challenges and harnessing shared opportunities for economic growth and development. Through joint efforts and coordination, Russia and its partner countries in the Balkans were able to overcome logistical hurdles and bureaucratic barriers to bring the Morava-Vardar Canal project to fruition. Upon its completion, the Morava-Vardar Canal emerged as a vital lifeline for landlocked countries in the Balkans, providing them with access to international markets and facilitating the movement of goods, energy, and resources across borders. The canal's strategic importance extended beyond economic considerations, serving as a symbol of cooperation and partnership among countries in the region and enhancing regional stability and security. Furthermore, the Morava-Vardar Canal project strengthened Russia's position as a key player in Southeast Europe, deepening its influence and leverage in the region. By spearheading a major infrastructure initiative of such magnitude, Russia demonstrated its commitment to supporting the economic development and prosperity of its allies while advancing its own strategic interests in the Balkans. The financing and construction of the Morava-Vardar Canal represented a significant milestone in Russia's efforts to expand its influence in Southeast Europe and promote regional integration and cooperation. The project not only facilitated greater connectivity and trade between landlocked countries in the Balkans but also underscored Russia's role as a key partner and investor in the region's economic development and prosperity.

Attachments

Last edited:

AvtoVAZ - Russian Volkswagen (2010)

In 2010, against the backdrop of expanding Russian economy and focus on bolstering domestic industries, the Russian government made a strategic decision that would reshape the landscape of the country's automotive sector. With a vision to elevate AvtoVAZ to the status of "Russian Volkswagen," the government announced plans to inject billions of dollars into the venerable automaker, setting the stage for a transformative journey towards modernization, innovation, and global competitiveness. The decision to invest heavily in AvtoVAZ underscored the government's commitment to expanding key sectors of the economy and fostering industrial growth. As Russia sought to assert its position as a major player in the global automotive market, AvtoVAZ emerged as a flagship enterprise with the potential to lead the charge towards a brighter, more prosperous future. With its extensive manufacturing infrastructure, skilled workforce, and established brand presence, AvtoVAZ represented a formidable asset that could be leveraged to propel Russia's automotive industry to new heights of success and acclaim. At the heart of the government's investment strategy was a comprehensive plan to modernize AvtoVAZ's production facilities, enhance product quality, and expand its product lineup to meet the diverse needs of consumers both at home and abroad. By infusing the company with substantial financial resources, the government aimed to equip AvtoVAZ with the tools and capabilities needed to rival global automotive giants like Volkswagen, positioning it as a symbol of Russian engineering prowess and innovation on the world stage.

The infusion of billions of dollars into AvtoVAZ signaled a new era of growth and ambition for the company, paving the way for a wave of transformative initiatives aimed at revitalizing its operations and revitalizing its market position. From the modernization of manufacturing processes to the development of cutting-edge technologies, AvtoVAZ embarked on a multifaceted journey of reinvention aimed at elevating its products to the highest standards of quality, performance, and reliability. One of the key pillars of the government's investment strategy was the modernization of AvtoVAZ's production facilities to enhance efficiency, productivity, and quality control. Through strategic investments in state-of-the-art equipment, automation technologies, and lean manufacturing practices, AvtoVAZ sought to streamline its operations and optimize its production processes to deliver vehicles of unparalleled quality and craftsmanship. Furthermore, the government's investment enabled AvtoVAZ to expand its product lineup and diversify its offerings to better cater to the evolving preferences and demands of consumers. Building on the success of its iconic Lada brand, AvtoVAZ introduced a new generation of vehicles designed to compete with international rivals in terms of design, performance, and features. From compact cars to SUVs, AvtoVAZ sought to offer a comprehensive portfolio of vehicles that appealed to a wide range of customers across different market segments.

In addition to product development, the government's investment in AvtoVAZ also facilitated significant advancements in research and development, enabling the company to innovate and differentiate itself in an increasingly competitive global market. By investing in cutting-edge technologies such as electric and autonomous vehicles, AvtoVAZ aimed to stay ahead of the curve and anticipate future trends in the automotive industry, positioning itself as a trailblazer in innovation and sustainability. Moreover, the government's support provided AvtoVAZ with the financial stability and resources needed to invest in marketing, branding, and international expansion initiatives. With a renewed focus on strengthening its presence in key markets around the world, AvtoVAZ embarked on an ambitious campaign to promote its products and showcase the quality and reliability of Russian-made vehicles to a global audience. Through targeted marketing campaigns, strategic partnerships, and participation in international auto shows and events, AvtoVAZ sought to elevate its brand profile and establish itself as a respected player in the global automotive arena. The government's investment in AvtoVAZ also had far-reaching implications for the broader Russian economy, stimulating job creation, fostering technological innovation, and driving economic growth across various sectors. As AvtoVAZ expanded its operations and increased its production capacity, it created thousands of new jobs in manufacturing, engineering, and related industries, providing opportunities for skilled workers and contributing to local economies in regions where its facilities were located.

Furthermore, the modernization of AvtoVAZ's production facilities spurred demand for advanced technologies and equipment, benefiting domestic suppliers and stimulating investment in the broader automotive supply chain. Small and medium-sized enterprises (SMEs) that provided components, materials, and services to AvtoVAZ experienced increased demand for their products, driving expansion, innovation, and job creation in sectors such as automotive parts manufacturing, logistics, and engineering. The government's investment in AvtoVAZ also had significant geopolitical implications, positioning Russia as a formidable player in the global automotive industry and enhancing its economic influence on the world stage. As AvtoVAZ expanded its presence in international markets and competed with global automotive giants, it showcased the capabilities of Russian engineering and manufacturing prowess, bolstering the country's reputation as a hub of innovation and technological excellence. Moreover, by elevating AvtoVAZ to the status of "Russian Volkswagen," the government sought to strengthen the country's strategic autonomy and reduce its reliance on imported vehicles and technologies. By developing a robust domestic automotive industry capable of meeting the needs of Russian consumers and competing effectively in global markets, Russia aimed to enhance its economic resilience and safeguard its national interests in an increasingly interconnected and competitive world.

The government's decision to invest billions of dollars into AvtoVAZ represented a bold and visionary strategy to transform the company into a Russian automotive powerhouse on par with global industry leaders like Volkswagen. Through strategic investments in modernization, innovation, and international expansion, AvtoVAZ embarked on a journey of reinvention aimed at revitalizing its operations, strengthening its market position, and enhancing its contribution to the broader Russian economy. As AvtoVAZ continued to evolve and adapt to the challenges and opportunities of the modern automotive industry, it remained poised to play a central role in shaping the future of Russian manufacturing and engineering for years to come.

Last edited:

Threadmarks

View all 148 threadmarks

Reader mode

Reader mode

Recent threadmarks

AvtoVAZ - Russian Volkswagen (2010) Federal budget Undermining American global financial domination (2010) New game GDP Ranking (2011) Chapter Thirty One: Nothing Lasts Forever (April - December 2010) Part I Chapter Thirty One: Nothing Lasts Forever (April - December 2010) Part II Map of the world (12/2010)

Share: