Brillstein II: Making a Run at Disney

Chapter 8, Frog Eats Mouse? (continued)

Excerpt from Where Did I Go Right? (or: You’re No One in Hollywood Unless Someone Wants You Dead), by Bernie Brillstein (with Cheryl Henson)

How does a frog eat a mouse? Not in a single swallow, that’s for sure.

Some of my business associates, all far smarter than me in this regard, did some digging and made some calculations. They determined, depending on fluctuations in the current stock price and interest rates, that gaining a controlling stake in Disney would require around $1.5 billion. Yes, that’s billion. With a “b”. That was higher than the GDP of some European countries at the time. Going through Jim’s finances with [Jim’s attorney and Business Manager] Al Gottesman and estimating the growth potential of the Muppets, my professional eggheads figured he might be able to secure, at best, about a tenth of that[1] between his liquid assets and a line of credit using the non-Sesame Street Muppets save Kermit (which I knew he’d never risk) as collateral.

So how does a frog eat a mouse? One bite at a time, it seems.

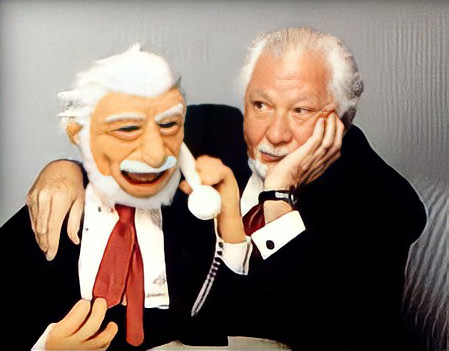

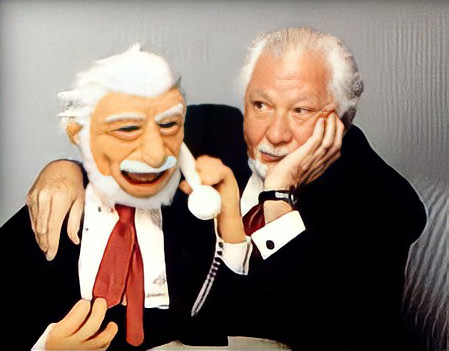

Bernie Brillstein in flesh and felt (image source "vignette.wikia.nocookie.net")

I gave Jim a call and told him the news. “Based on your current assets we think you can pull in about 3-7% of the outstanding shares. It’s not nearly enough for a flat-out buy, but it might get you a seat or two on the Board of Directors.”

“But will it get me enough creative control?” he asked. Right to the point. I love Jim.

“With that big of a share they’ll have no choice but to listen to you, and soon.”

The line went quiet. Then, finally, Jim said, “Let’s do it.”

We were a “go”.

Over the next few months, while he took Crystal further into pre-production and began putting together a promotional short for it, among other small projects, I arranged the buys. I set up a partnership with a talented business manager I knew and we arranged a strategy for the quiet acquisition of the shares. We decided to keep things as under the radar as possible, using a shell company we whipped up. We didn’t want word to get out that Jim Henson was buying up Disney shares or sure as hell the stock prices would climb and price Jim out. We also had a 5% threshold where we had to register the stock buys with the SEC, which would let the cat out of the bag. The clock was ticking.

Even so, we decided to have some fun while we were at it. We decided to name the shell company after one of the creatures from The Dark Crystal, both as an inside joke and since no one else at the time would have gotten the reference. We kicked around a few names: H.R. Podling, Inc., The Gelfling Group, URRU LLC., before finally setting on my personal favorite: Skeksis Holdings. To this day I keep a bronze bust of a Skeksi [SIC] on my desk as a reminder of the fun I had with that.

Throughout the fall and winter of ’79 and into the spring of ’80 we began our quiet accumulation of outstanding Disney stock. Nothing we did was technically illegal, but Jim was not happy with the subterfuge. It seemed dishonest to him. I reminded him of our deal: I don’t tell him how to make Muppets and he doesn’t tell me how to make sausage.

And this is the secret of our relationship. The truth is that Jim was like the mystical, dreaming Urru [SIC] and I was like the conniving, ambitious Skeksis. Apart, the two species are so lost in their own bullshit that they get nothing done and the world crumbles around them.

But when they come together, magic happens.

Jim understood this simple fact of life, even back then.

Then, in April of ‘80, the suns aligned for us: Disney’s latest film, The Watcher in the Woods, bombed spectacularly. Hell, it atomic-bombed! It was such a disaster that they pulled it from the theaters after 10 days and re-ran Mary Poppins instead. Their stock price plummeted and we started to gobble up shares like some hippie Pac Man with the munchies. By the time it was all said and done we’d grabbed Jim a full 8.3% share of Disney, all the stocks waiting in the shell company.

All Jim had to do was bring the shares to him like the shard to the Crystal.

[1] I plan to justify these numbers in a separate post in the near future.

Excerpt from Where Did I Go Right? (or: You’re No One in Hollywood Unless Someone Wants You Dead), by Bernie Brillstein (with Cheryl Henson)

How does a frog eat a mouse? Not in a single swallow, that’s for sure.

Some of my business associates, all far smarter than me in this regard, did some digging and made some calculations. They determined, depending on fluctuations in the current stock price and interest rates, that gaining a controlling stake in Disney would require around $1.5 billion. Yes, that’s billion. With a “b”. That was higher than the GDP of some European countries at the time. Going through Jim’s finances with [Jim’s attorney and Business Manager] Al Gottesman and estimating the growth potential of the Muppets, my professional eggheads figured he might be able to secure, at best, about a tenth of that[1] between his liquid assets and a line of credit using the non-Sesame Street Muppets save Kermit (which I knew he’d never risk) as collateral.

So how does a frog eat a mouse? One bite at a time, it seems.

Bernie Brillstein in flesh and felt (image source "vignette.wikia.nocookie.net")

I gave Jim a call and told him the news. “Based on your current assets we think you can pull in about 3-7% of the outstanding shares. It’s not nearly enough for a flat-out buy, but it might get you a seat or two on the Board of Directors.”

“But will it get me enough creative control?” he asked. Right to the point. I love Jim.

“With that big of a share they’ll have no choice but to listen to you, and soon.”

The line went quiet. Then, finally, Jim said, “Let’s do it.”

We were a “go”.

Over the next few months, while he took Crystal further into pre-production and began putting together a promotional short for it, among other small projects, I arranged the buys. I set up a partnership with a talented business manager I knew and we arranged a strategy for the quiet acquisition of the shares. We decided to keep things as under the radar as possible, using a shell company we whipped up. We didn’t want word to get out that Jim Henson was buying up Disney shares or sure as hell the stock prices would climb and price Jim out. We also had a 5% threshold where we had to register the stock buys with the SEC, which would let the cat out of the bag. The clock was ticking.

Even so, we decided to have some fun while we were at it. We decided to name the shell company after one of the creatures from The Dark Crystal, both as an inside joke and since no one else at the time would have gotten the reference. We kicked around a few names: H.R. Podling, Inc., The Gelfling Group, URRU LLC., before finally setting on my personal favorite: Skeksis Holdings. To this day I keep a bronze bust of a Skeksi [SIC] on my desk as a reminder of the fun I had with that.

Throughout the fall and winter of ’79 and into the spring of ’80 we began our quiet accumulation of outstanding Disney stock. Nothing we did was technically illegal, but Jim was not happy with the subterfuge. It seemed dishonest to him. I reminded him of our deal: I don’t tell him how to make Muppets and he doesn’t tell me how to make sausage.

And this is the secret of our relationship. The truth is that Jim was like the mystical, dreaming Urru [SIC] and I was like the conniving, ambitious Skeksis. Apart, the two species are so lost in their own bullshit that they get nothing done and the world crumbles around them.

But when they come together, magic happens.

Jim understood this simple fact of life, even back then.

Then, in April of ‘80, the suns aligned for us: Disney’s latest film, The Watcher in the Woods, bombed spectacularly. Hell, it atomic-bombed! It was such a disaster that they pulled it from the theaters after 10 days and re-ran Mary Poppins instead. Their stock price plummeted and we started to gobble up shares like some hippie Pac Man with the munchies. By the time it was all said and done we’d grabbed Jim a full 8.3% share of Disney, all the stocks waiting in the shell company.

All Jim had to do was bring the shares to him like the shard to the Crystal.

[1] I plan to justify these numbers in a separate post in the near future.

Last edited: